Of all the big events scheduled for the foreign exchange market this week, the Reserve Bank of New Zealand's monetary policy announcement is the most exciting. The RBNZ is widely expected to raise interest rates for the second month in a row after holding rates steady for the past 3 years. Back in March, the Reserve Bank became the first major central bank to raise interest rates since the global financial crisis and each one of the 15 economists surveyed by Bloomberg expect another 25bp of tightening later today. When the central bank raised rates in March they kicked off a rally that took the New Zealand dollar from 0.8460 to 0.8745 over a one-month period with very little retracement. However we don't expect this month's rate hike to have the same affect on the New Zealand dollar. The chance of NZD/USD hitting fresh 2.5-year highs on the back of RBNZ is slim while the chance of the currency pair slipping to 85 cents is high.

Why Would a Rate Hike be Negative for NZD?

Normally an interest rate hike by a central bank is very positive for the currency especially when they are the only ones tightening but in the case of the RBNZ, they could say future rate hikes will be conditional on data, which would suggest a pause in June. Investors started to load up on the New Zealand dollar after the RBNZ said they would raise rates form 2.5% to 4.75% by the first quarter of 2016 and they added to their exposure when the central bank began to tighten. According to the CFTC, this demand drove speculative long positions in NZD/USD to their highest level since May 2013. If the RBNZ were to adopt a less hawkish posture, it would trigger further unwinding of long NZD/USD positions that could take the currency pair to 84 cents even if it the RBNZ remains one of the world's most hawkish central banks.

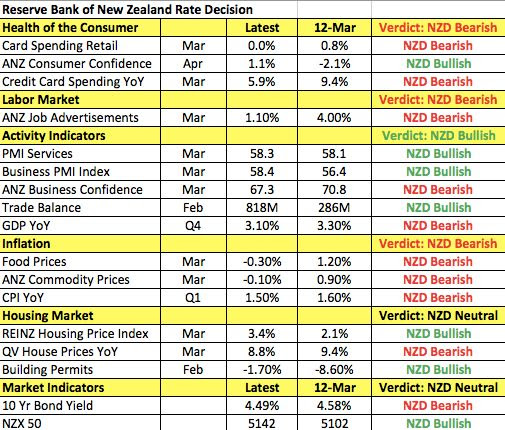

The following table shows how the New Zealand economy changed since the last monetary policy meeting. As you can see, there has been more deterioration than improvements particularly on the spending and inflation front. Over the past 2 months, milk prices have fallen approximately 20%, driving inflation and terms of trade lower. When the RBNZ last raised rates in March, the move was necessary to keep a lid on inflation. At the time, the RBNZ raised its inflation projection to 1.9% from 1.5%. However according to the latest CPI report, inflation is slowing and not rising and given this environment further rate hikes may not be appropriate. Despite an improvement in consumer confidence, credit card spending weakened, suggesting a slowdown in consumer demand. Service and business activity accelerated in March but given the drop in business confidence and the decline in commodity prices, we would not be surprised if the improvements were reversed in April. Many of the reasons that Governor Wheeler provide as a justification for the March rate hike, from inflation to consumer and business sentiment and hiring intentions have weakened, giving the central bank just cause to slow their pace of tightening.

However even if the RBNZ pauses in June, they are still on a longer course of tightening which is why we believe a pullback in NZD/USD should be limited to 84 cents. Of course if the RBNZ tightens and remains committed to their hawkish monetary policy plans, NZD will soar as traders who sold above 87 cents reload their long positions.

Commodity currencies in general are on the move this morning with the Australian dollar dropping close 1% on the back of last night's softer than expected consumer price report. The Canadian dollar also extended its losses after their retail sales report showed consumer spending growing at a slower pace in the month of February. Despite a rebound in job growth, Canadians have been cautious about spending, reinforcing the Bank of Canada's belief that the recovery will be gradual and in reaction, USD/CAD rose to its strongest level in 3 weeks.

Kathy Lien, Managing Director of FX Strategy for BK Asset Management.