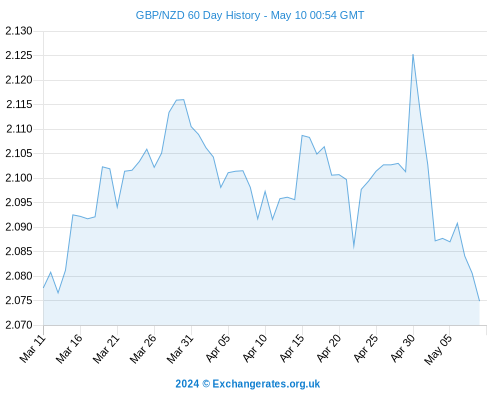

The Pound (GBP) to New Zealand Dollar exchange rate (GBP/NZD) was seen to have traded lower during the mid-week session, following a boost for the currency and its commodity prices.

The NZ currency has seen further gains today against a basket of currencies such as the Pound Sterling (GBP), Euro (EUR), Australian Dollar (AUD) and US Dollar (USD).

Today's forex rates show the following currency levels (money transfers from NZ):

- The New Zealand Dollar to Australian Dollar exchange rate is 0.16 per cent higher at 0.89716 NZD/AUD.

- The New Zealand Dollar to Canadian Dollar exchange rate is 0.18 pct up at 0.91081 NZD/CAD.

- The New Zealand Dollar to Euro exchange rate is trading 0.17% pct higher at 0.63624 NZD/EURNote: these are inter-bank forex rates to which margins are applied when transferring money abroad - speak to a recommended FX provider to lock in the best exchange rates.

New Zealand dairy giant Fronterra has revealed its intent to take up a 20% stake in one of China’s—it’s largest trading partner—biggest and most influential dairy companies, Beingmate.

Sending large amounts of money abroad? Did you know you could save compared to using the high street banks? Get a free guide and start a chat with our team of foreign exchange experts.

In recent weeks it became apparent that China would be struck by a milk shortage, and would be likely to trade more with New Zealand to compensate.

This positive news for the New Zealand economy has buoyed the ‘Kiwi’ at a time when it has been struggling against other majors. The Pound has seen gains against the New Zealand Dollar in the latter five days; however, the gains are tapering off following the Fronterra deal.

The news of Fronterra’s recent agreement with Beingmate will come as a relief to some who feared the slashed dairy prices could create a dramatic effect on the New Zealand economy.

Chief Executive for Fronterra Theo Spierings suggested that such a partnership would prove to be a ‘game changer’ which would facilitate ‘a direct line into the infant formula market in China.’ Fronterra intends to work alongside the Chinese dairy manufacturer to: ‘evaluate mutual investments in dairy farms in China. The partnership will create a fully integrated global supply chain from the farm gate direct to China’s consumers, using Fronterra’s milk pools and manufacturing sites in New Zealand, Australia, and Europe.’

Tuesday evening however saw the New Zealand food prices, drop in July by -0.7% month-on-month in comparison to June’s 1.4% growth. Thursday will show Building Permits figures in New Zealand followed by Activity Outlook, Business Confidence and Private Sector Credit statistics on Friday.

Strong Pound Sterling Causes Losses for UK Companies in the First Half of 2014

The Pound (GBP) passed through an extended phase of trading highly in the currency market in recent months, before crashing down to lower levels following poor UK data publications and dashed hopes for interest rate hikes.

However, the strength of Sterling has played havoc for companies trading in the first half of 2014, with business giants such as Burberry claiming massive losses.

Energy provider Cape Plc has stated today that they have been bruised by a 13% fall in profits made before taxation due to the Pound’s formerly high exchange rate in the currency market, alongside less project availability. An expert in the field stated: ‘We believe a ramp-up in activity at Wheatstone, an improving UK onshore margin, as well as the positive impact of the Motherwell Bridge acquisition provides visible growth in 2H14 and 2015.’

Thursday is due to see the Lloyds Bank Business Barometer and UK CBI Reported Sales figures reach publication, whilst UK Consumer Confidence and Nationwide House Prices are revealed on Friday. The Pound has seen a period of weakness and volatility, and would need positive figures this week in an attempt to raise it from the troughs that it’s sank into in recent weeks.