The near collapse of the Co-operative bank blew the chance to create a full blown challenger bank to shake up the high street, according to a parliamentary report which calls for further inquiries into the roles of the bank’s auditors and regulators in the scandal.

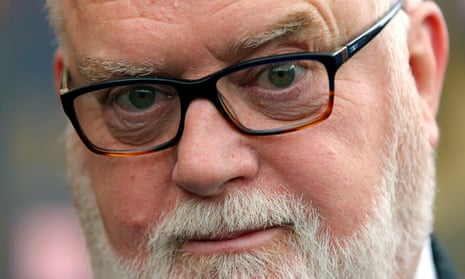

Former bosses should take the biggest share of responsibility, the report said, highlighting that the structure of the board led by former chairman Paul Flowers was “an accident waiting to happen”.

The report by the Treasury select committee into the aborted attempt by Co-op bank to buy 631 branches from Lloyds Banking Group concludes that Flowers’ appointment should never have been permitted by the then City regulator, the Financial Services Authority.

It also rejected allegations of political meddling in the sale of the Lloyds branches – code named Verde – allegations made by Lord Levene who told the committee that interference ruined the chances of a rival offer he was fronting for bid vehicle NBNK.

Co-op pulled out of its bid in April 2013 just weeks before being downgraded by Moody’s and revealing it had a £1.5bn capital shortfall. The debacle has ended with the owner Co-operative Group left with only 20% of the bank.

Andrew Tyrie, the Conservative MP who chairs the select committee, said: “It is not uncommon for deals to collapse. But in this case it was caused by the near collapse of Co-op Bank itself. Each of the backstops – Co-op Bank, KPMG as its auditor and the FSA as its regulator – failed to uncover the bank’s capital shortfall until it was too late. Each had a hand in this sorry tale. But by far the biggest responsibility lies with the Co-op Bank leadership.”

The 127-page report sets out questions for the two investigations to come – one by the accounting watchdog the Financial Reporting Council and an independent one commissioned by the chancellor, George Osborne. Among the questions is establishing why it took so long for the bank’s capital shortfall to emerge. The chancellor is yet to name who will run the independent inquiry which will begin once enforcement action by the City regulator is completed.

The report questions the roles of the auditors, KPMG, asking why it took so long to uncover £500m of bad debts amassed after the merger with Britannia building society in 2009.

It said the Britannia deal should not have happened and the former management of the building society should also accept “responsibility for originating the distressed assets”.

KMPG said the FRC was conducting an investigation and said “we believe that we have provided robust audits which challenged the judgements and disclosures proposed by the bank’s management”.

Tyrie said: “It could turn out after closer scrutiny the auditor and regulator could and should have identified these problems before they became so severe. Nonetheless, the former management of Co-op Bank bears primary responsibility for the calamity that has befallen it.”

Tyrie said questions remained about whether the capital shortfall should have been uncovered sooner.

“The FRC’s investigation and the Treasury-commissioned inquiry into Co-op Bank need to examine this in depth,” he said. The independent inquiry should “form a view on whether Co-op’s Verde bid could or should have been halted sooner”.

The committee’s findings endorse those by Sir Christopher Kelly in April who also found no evidence of political interference and concluded the Britannia deal should not have gone ahead.

Even so, the conclusion by the MPs on the committee that Levene’s allegations could not be substantiated were seized upon by Lloyds as vindicating its assertions that it was not leant on by politicians. Whitehall sources also said the report highlighted “very poor judgement” by shadow Chancellor Ed Balls who had said Osborne had questions to answer over potential political interference. Levene said he did not “wish to amend my evidence” which had included references to former Bank of England governor Lord King.

The select committee pointed out, however, that it had not had access to the record of the government’s contacts with bidders during the process, which the Chancellor would give to the independent inquiry.

It also said that the collapse of Co-op’s bid for the Lloyds branches – which have since been floated on the stock market as TSB – had damaged the prospects of a proper challenger bank emerging. “There is a risk that a bank of this size might struggle to grow significantly and to act as a true challenger in the market,” Tyrie said.

The verdicts within the report

On political interference to encourage Lloyds to sell branches to Co-op

“The committee has seen no evidence....that the goodwill expressed by the Government amounted to pressure.”

On Co-op Bank’s 2009 merger with Britannia Building Society

“The commercial judgment behind the decision appears questionable.”

On the Co-op Bank’s board

“By far the biggest responsibility [for the near collapse of the bank] lies with the Co-op Bank leadership.”

On Paul Flowers, the former chairman of the Co-op Bank

“Mr Flowers lacked both the desirable experience and the minimum essential skills. He should not have put himself forward for the role.”

On the former City watchdog, the Financial Services Authority

“The regulator should not have permitted [Flowers’] appointment.”

On KPMG, the Co-op Bank’s auditors

“The independent inquiry into events at Co-op Bank should look closely at the shortcomings of the bank’s auditor, KPMG.”

Comments (…)

Sign in or create your Guardian account to join the discussion