The New Zealand Dollar (NZD) exchange rate was able to reclaim losses against major currencies such as the British Pound (GBP) and Euro (EUR) while trending lower against close neighbour, the Australian Dollar (AUD).

The NZ Dollar was placed under pressure when the New Zealand Trade Balance recorded an unfavourable figure.

A quick forex market summary before we bring you the rest of the report:

On Thursday the Pound to British Pound exchange rate (GBP/GBP) converts at 1

The live inter-bank GBP-GBP spot rate is quoted as 1 today.

At time of writing the pound to us dollar exchange rate is quoted at 1.247.

The GBP to EUR exchange rate converts at 1.168 today.

The GBP to AUD exchange rate converts at 1.933 today.

Please note: the FX rates above, updated 18th Apr 2024, will have a commission applied by your typical high street bank. Currency brokers specialise in these type of foreign currency transactions and can save you up to 5% on international payments compared to the banks.

Aus Dollar to New Zealand Dollar Exchange Rate Today

The monthly trade deficit narrowed to -$908 million in October from -$1367 billion. However, economists’ had expected a bigger narrowing to -$642 million. The larger than expected trade deficit has been attributed to a tumble in dairy exports to New Zealand’s largest trading partner, China. With New Zealand Business Confidence data still to come, the ‘Kiwi’ may be offered a chance to extend its gains against other currency majors. Both the Australian Dollar and the New Zealand Dollar were able to advance when the People’s Bank of China (PBOC) took steps to loosen its monetary policy to encourage growth.

As China is both Australia and New Zealand’s largest trading partner, any positive development by one of the world’s largest economies can help the Oceanic currencies gain. Friday will see House Affordability and Private Sector Credit stats released which could help the ‘Aussie’ extend its advances if upbeat. One other positive aspect for the ‘Aussie’ is the possibility of iron ore prices rebounding in the near future. Like New Zealand’s dairy prices, Australia’s iron ore values have slumped rather dramatically since the beginning of the year. One of the world’s top iron ore producers, Vale, has suggested that despite the 49% fall this year, it wasn’t preparing to slow its production.

Vale spokesperson Murilo Ferreira stated: ‘There was a lot of volatility in prices this year and the market is undershooting at the moment and this will bring about a correction. This correction will come through the closure of many inefficient miners of high cost and poor quality iron ore.’

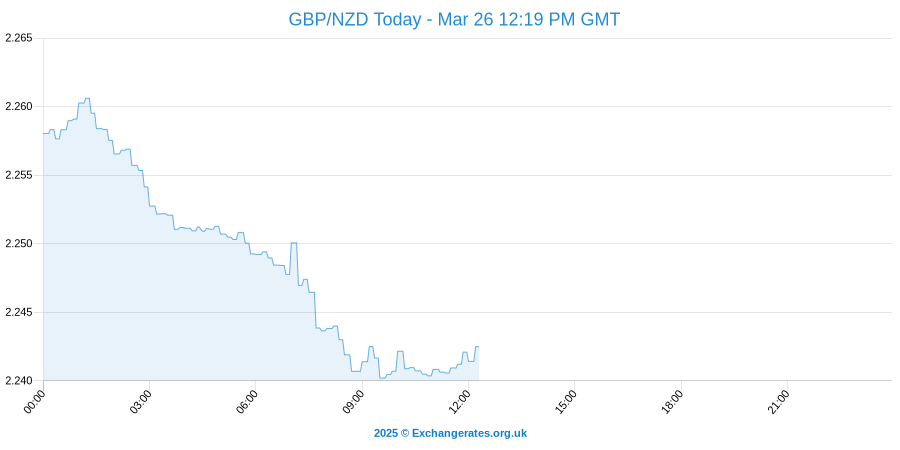

Pound to NZ Dollar Exchange Rate Today

Meanwhile, the Pound depreciated against other currency majors as UK political discussions continued. The Scottish referendum was an event this year that saw the Pound tumble. However, now the finer details of the referendum outcome are being ironed out causing much political debate. Scotland wants to take control of income taxes as part of the powers passed on from the UK. UK Consumer Confidence will be out on Friday which could see the Pound exchange rate fluctuate.

Sending large amounts of money abroad? Did you know you could save compared to using the high street banks? Get a free guide and start a chat with our team of foreign exchange experts.

Pound to New Zealand Dollar Exchange Rate Forecast

The Eurozone saw German figures remain steady in November, with the Consumer Price Index (CPI) remaining at 0.6%. Furthermore, German Unemployment Rate stats were revised down in October to 6.6% from 6.7%, where they remained throughout November. Eurozone Economic Confidence also increased from 100.7 to 100.8, despite being forecast to fall. Friday will be a highly influential day for the Euro when Eurozone Consumer Price Index figures are out. Furthermore, Eurozone Unemployment Rate stats will surface which economists’ predict will remain at 11.5%.

NZD/GBP, NZD/EUR, NZD/AUD Trending Lower after OPEC outcome, NZ Confidence Up

The New Zealand Dollar had been trending softer against other majors after the recent Organisation of the Petroleum Exporting Countries (OPEC) meeting saw commodity prices tumble. With the conclusion that oil production should maintain its current momentum, crude values flopped bringing down other commodities with it. Meanwhile, New Zealand Business Confidence rose in the month of November from 26.5 to 31.5.