Today's Pound Sterling Forecasts & Forex News vs the Euro and the US Dollar

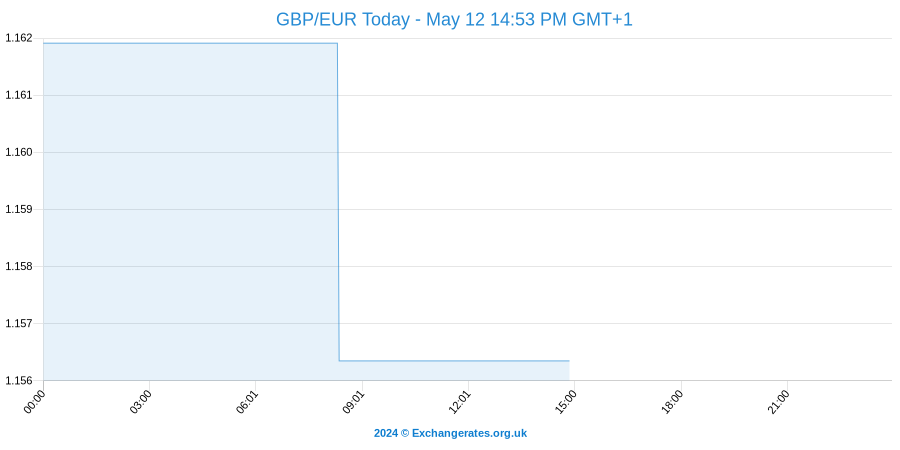

Thursday's afternoon session finds the Pound to Euro conversion rate 0.18 pct higher in comparison to the day's open.

However, whilst the British Pound fared well against the euro, the US Unemployment Claims saw the Pound to Dollar soften 0.24 per cent aover the course of the day.

A quick foreign exchange rate market summary before we bring you the rest of the report:

On Friday the Euro to British Pound exchange rate (EUR/GBP) converts at 0.856

The live inter-bank GBP-EUR spot rate is quoted as 1.168 today.

The pound conversion rate (against us dollar) is quoted at 1.244 USD/GBP.

The GBP to CAD exchange rate converts at 1.713 today.

NB: the forex rates mentioned above, revised as of 19th Apr 2024, are inter-bank prices that will require a margin from your bank. Foreign exchange brokers can save up to 5% on international payments in comparison to the banks.

British Pound to Euro Exchange Rate Forecast

The Pound began the European session trading in a softer position against the Euro and went on to hit a low of 1.3539 following the publication of French growth and German confidence data.

The French fourth quarter growth report confirmed that the Eurozone’s second largest economy expanded by 0.1% in the final quarter of 2014 on a quarter-on-quarter basis and grew 0.2% on the year.

The nation’s public deficit was also shown to have increased by slightly less than expected last year, coming in at 4.0% of GDP rather than the 4.4% previously estimated.

According to one source;

‘Finance Minister Michel Sapin hailed the unexpected deficit figure on Thursday, saying it raised the possibility the public deficit in 2015 could stand at 3.8% of GDP instead of the 4.1% currently estimated.’

German Confidence Data Sends EUR/GBP Exchange Rate Higher

While the French figures had little impact on Euro trading, the common currency was supported by Germany’s GfK Consumer Confidence index, which advanced to 10 from 9.7.

Even the UK’s surprising monthly retail sales growth of 0.7% wasn’t enough to give the Pound a leg up against its European peer.

Economists had only expected monthly sales growth of 0.4%, but yesterday’s comments from Bank of England policymaker Kirstin Forbes regarding the possibility of the central bank cutting interest rates in the future kept the Pound under pressure.

Pound to Dollar Exchange Rate Forecast

On Wednesday the Pound to dollar rate was able to advance back above the 1.49 level thanks to a shockingly steep slide in US Durable Goods Orders.

Economists had expected durable goods orders in the world’s largest economy to have increased by 0.2% on the month, however, orders actually plummeted by -1.4%.

Demand for the USD was further undermined by comments issued by Federal Reserve Bank of Chicago President Charles Evans.

Evans implied that the Fed should keep borrowing costs on hold for the foreseeable future. He stated;

‘I think economic conditions are likely to evolve in a way such that it will be appropriate to hold off on raising short-term rates until 2016 [...] Given uncomfortably low inflation and an uncertain global environment, there are significant risks, but few benefits, to increasing interest rates prematurely. A prudent risk management and goal-orientated approach to US monetary policy dictates that we continue to assess inflation developments for some time before generating more restrictive financial conditions.’

The Pound to US Dollar currency pair was trading in the region of 1.4933 before the US released its Markit Services/Composite PMI