The Australian Dollar Rallies on RBA Rate Freeze Stacks with Rising Building Permits Today

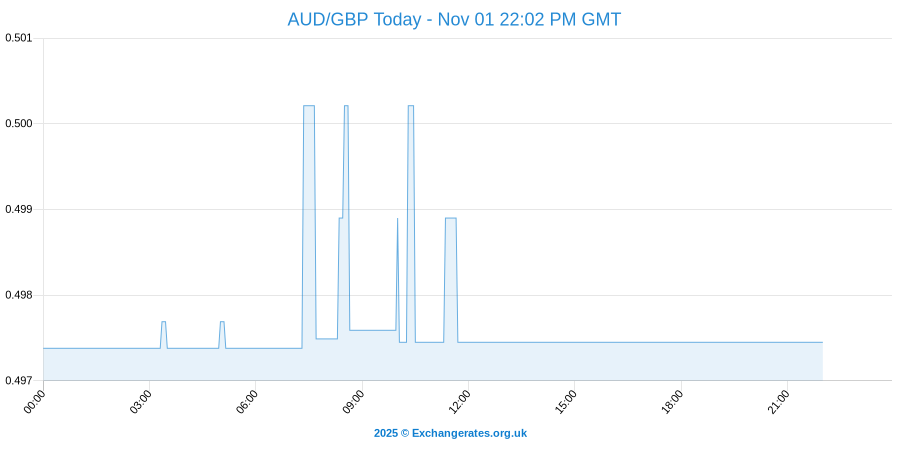

On Thursday morning the Australian Dollar continues to extend gains versus the Pound Sterling and the Euro.

The Australian dollar exchange rate appreciation can be linked to data out of China which showed the Composite PMI moved out of contraction territory and into growth.

The euro declined across the board this morning as traders prepare for the European Central Bank interest rate decision, in which the majority of economists believe policymakers will opt to ease monetary policy further.

Although British data produced positive results, with the Services PMI bettering estimates, the Pound is holding a comparatively weak position versus most of its peersOn Friday the Pound to British Pound exchange rate (GBP/GBP) converts at 1

The live inter-bank GBP-GBP spot rate is quoted as 1 today.

At time of writing the pound to euro exchange rate is quoted at 1.168.

The pound conversion rate (against us dollar) is quoted at 1.243 USD/GBP.

FX markets see the pound vs chinese yuan exchange rate converting at 9.004.

Please note: the FX rates above, updated 19th Apr 2024, will have a commission applied by your typical high street bank. Currency brokers specialise in these type of foreign currency transactions and can save you up to 5% on international payments compared to the banks.

Australian Dollar (AUD) Exchange Rates Strengthen despite Supportive US Economic Events Today

A speech from Fed official Dennis Lockhart has raised the value of the US Dollar today, on account of Lockhart’s perceived hawkishness regarding the December 16th Federal Open Market Committee (FOMC) Interest Rate Decision.

The Australian Dollar, meanwhile, has been performing well in spite of this ‘Buck’ positive news, stabilising its hold on the advantageous rates against the Pound Sterling and Euro.

The impending AiG Performance of Services Index still has no predictions assigned to it, but further ahead the New Homes Sales and Trade Balance figures for October could initiate major ‘Aussie’ movement.

AUD Exchange Rates Take a Hit Today despite Supportive Domestic Data

A recent speech by Reserve Bank of Australia (RBA) Governor Glenn Stevens should have seen the Australian dollar exchange rate jump up against its peers, due to the optimistic tone that Stevens used.

However, the AUD exchange rates have been in a tight range against most of the competition today, a stark contrast to yesterday’s bullish status.

This is thought to be due to the downwards movement of the price of copper, which has dropped off from almost $2.0700 to under $2.0620 today.

Worsening US Confidence sees Australian Dollar (AUD) Exchange Rate Jump Higher Today

The day has only gotten better over time for the Australian Dollar exchange rate complex, with the currency tightening its grip on currencies such as the Pound Sterling, Euro and US Dollar.

This is due to the result of the day’s biggest US economic publication, the ISM Manufacturing figure for November.

Forecasts had been optimistic, with a rise from 50.1 to 50.5 on the cards. However, the reality was far worse with a drop to 48.6 being recorded. This has severely disappointed investors, as this number indicated that the USD has contracted in this particular field.

Earlier today, the Australian Dollar (AUD) advanced across the foreign exchange rate markets, trending higher against a major currency rivals such as the Pound Sterling, the Euro and the US Dollar today.

This has come about from the US Dollar softening considerably, which has in turn driven up the appeal of ‘riskier’ currencies such as the ‘Aussie’ and the New Zealand Dollar as well.

The Australian Dollar has also been raised in value by the decision of the Reserve Bank of Australia (RBA) to freeze the national interest rate at 2%.

The Aus Dollar is likely to be moved further by RBA activity in the near-future, with a speech from Governor Glenn Stevens due tonight.

Pound to Australian Dollar in a Tight Trading Range Today after BoE Stress Test Results In

The Pound Sterling to Australian Dollar exchange rate dived today, more due to the strong status of the latter currency than any major deficiency in the former.

The Pound has been affected today by the Bank of England (BoE) Stress Tests that have analysed the capabilities of seven major UK banks to weather recession-type conditions; all of the institutions in question passed, although RBS and Standard Chartered came out the worst from the estimations.

The other UK news has been less positive, with the Markit November PMI for Manufacturing falling from 55.2 points to 52.7.

The next UK data will be tomorrow’s Construction PMI for November, which has been predicted to decline from 58.8 points to 58.5.

The Australian Dollar to Pound Sterling (AUD/GBP) exchange rate is currently trending in the region of 0.4834.

Euro (EUR) has Strong Showing Overall Today on Supportive Unemployment Rate Results

The Euro to Australian Dollar conversion rate has dropped today, but elsewhere the common currency has generally been performing well against the pressures of Thursday’s European Central Bank (ECB) Policy Review.

The most high-impact Eurozone results today have both been positive, with both the German and Eurozone Unemployment Rates for November and October falling from 6.4% to 6.3% and 10.8% to 10.7% respectively.

The next Euro data to look out for will be tomorrow’s annual Eurozone CPI figures. Forecasts were for a repeat figure of 1.1% with the Core result and a marginal increase from 0.1% to 0.2% for the Estimate.

US Dollar (USD) Weakened by Reduced Fed Rate Hike Prospects after Poor Chinese Data Today

The US Dollar to Australian Dollar exchange rate has declined substantially today, primarily because the US Dollar is still reeling from a detrimental attitude regarding the impending Federal Open Market Committee (FOMC) Interest Rate Decision.

The Chinese Manufacturing PMI failing to breach 50 today is the main cause for this pessimistic outlook, as a weaker Chinese economy reduces the incentive of the Fed to raise the US interest rate.

US data out today is mainly made up of October’s Construction Spending figure and November’s ISM Manufacturing result for November; at the time of writing, the latter was forecast to rise from 50.1 points to 50.5.

The Australian Dollar to US Dollar (AUD/USD) exchange rate is currently trending in the region of 0.7293.