2015 has been tough for the New Zealand Dollar, with GDP dropping to 2.4 per cent and unemployment rising to 6.2 per cent.

The fluctuating price of dairy products has also created problems for the New Zealand Dollar exchange rate, with the GlobalDairyTrade index dropping as many times as rising during the second half of the year.

The index hit a record more-than ten year low on the 4th of August and ends 2015 at a level not seen since the third quarter of 2009.

A slump in global commodity prices has also harmed New Zealand Dollar exchange rates, although US Dollar weakness in the run up to the Federal Reserve’s interest rate decision has provided several opportunities for NZD to reclaim a little lost ground towards the end of the year.

According to an ANZ forecast for 2016: ‘Risks include the weather, the global scene, low export prices and deteriorating structural metrics, but there are reasons for cautious optimism too. Respectable growth should see the unemployment rate begin to fall again by late 2016 although questions remain over inflation dynamics.’

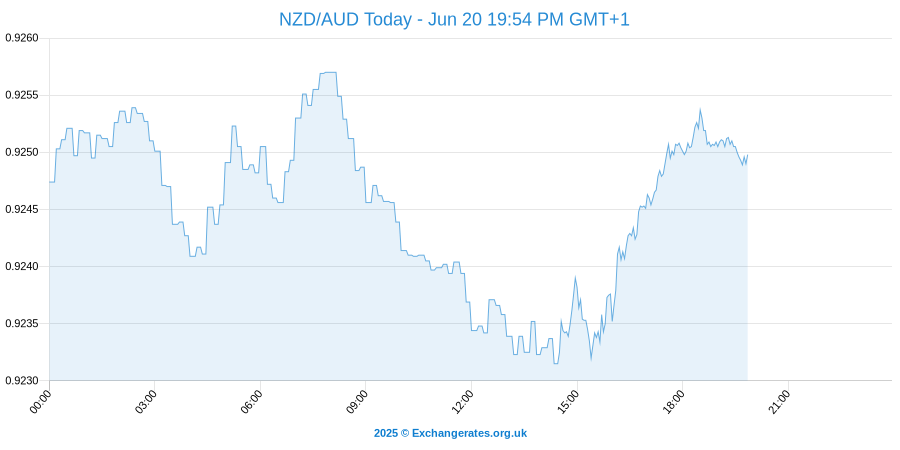

here are some forex rates for your reference:

On Tuesday the Pound to British Pound exchange rate (GBP/GBP) converts at 1

The pound conversion rate (against pound) is quoted at 1 GBP/GBP.

The live inter-bank GBP-AUD spot rate is quoted as 1.935 today.

Today finds the pound to us dollar spot exchange rate priced at 1.244.

NB: the forex rates mentioned above, revised as of 16th Apr 2024, are inter-bank prices that will require a margin from your bank. Foreign exchange brokers can save up to 5% on international payments in comparison to the banks.

Overall, the ANZ New Zealand Dollar forecast for 2016 paints a positive picture for the New Zealand economy, with GDP and inflation predicted to rise, while unemployment falls.

New Zealand GDP is forecast to grow marginally to 2.5% in 2016 and 2.8% in 2017, while unemployment will drop from 6.2% in 2015 to 5.9% next year and 5.6% in 2017.

The forecast identifies lower mortgage costs, a strong demand for construction, record annualised population growth (including immigration) and a booming tourism sector as key drivers in New Zealand’s economic success over the coming years.

Sending large amounts of money abroad? Did you know you could save compared to using the high street banks? Get a free guide and start a chat with our team of foreign exchange experts.

Strong USD will weaken AUD, relieving pressure on the Reserve Bank of Australia (RBA), according to a Westpac 2016 forecast.

Australia’s economy has been hit hard by falling commodity prices this year, with iron ore (the country’s top export) falling from US$67.39 in January to US$46.16 in November, the lowest level since December 2007.

Despite slumping prices, Australia has been able to weather the storm surprisingly well, with signs that the economy has begun to shift away from an overreliance on mining.

In the face of a strengthening US Dollar, with the Federal Reserve predicted to hike rates again in 2016 between two and four times, Westpac have stated that:

‘We do not expect to see the Reserve Bank needing to raise Australia’s overnight rate until the second half of 2017, by which time we expect the Federal funds rate to be around 2.0%.’

Citibank Forecast Strong 2016 for US Dollar Yet Predict GDP Will Slow to 2.5%

Between 1947 and 2015 US economic growth has averaged 3.24%, with 2015 Q3 growth at 2.1%.

According to Citibank US Gross Domestic Product will remain steady, under the average at 2.5% through until 2017, with inflation predicted to hit 1.6% in 2016 and 1.8% in 2017.

While predicting a strong year for the US Dollar, in which the currency remains dominant, Citibank have also noted that:

‘The 2016YE outlook is clouded by mildly rich valuations, Fed hikes and the presidential election.’