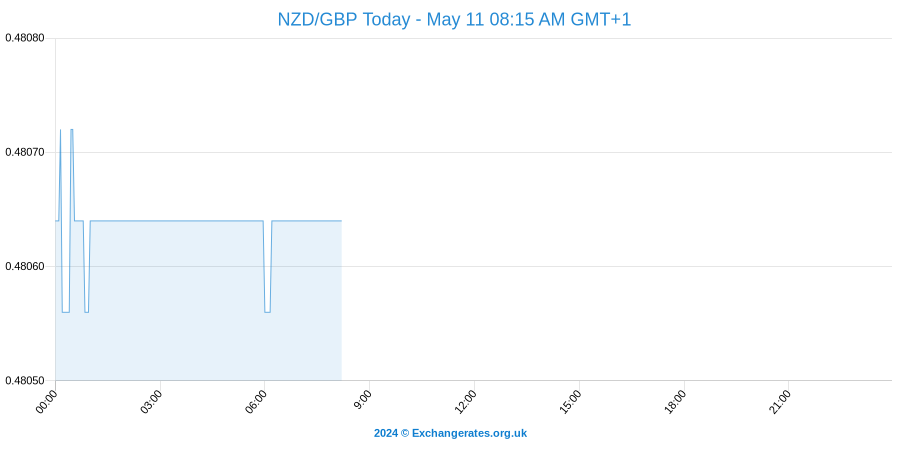

The New Zealand dollar to pound sterling rate (GBP/NZD) rallied today after positive domestic labour market data supports demand.

In response to better-than-forecast labour market data, in conjunction with positive data pertaining to China, New Zealand Dollar (NZD) rallied.

However, the appreciation is unlikely to be positively received by the Reserve Bank of New Zealand (RBNZ) after officials’ signalled overvaluation as a reason to cut the overnight cash rate.

Analysts at Westpac forecast the RBNZ to slash rates by 50 basis points this year, starting in March.

Here are some of the common fx rates for your consideration;

On Thursday the Pound to British Pound exchange rate (GBP/GBP) converts at 1

The live inter-bank GBP-GBP spot rate is quoted as 1 today.

The pound conversion rate (against euro) is quoted at 1.169 EUR/GBP.

The GBP to AUD exchange rate converts at 1.937 today.

NB: the forex rates mentioned above, revised as of 18th Apr 2024, are inter-bank prices that will require a margin from your bank. Foreign exchange brokers can save up to 5% on international payments in comparison to the banks.

New Zealand Dollar (NZD), Pound Sterling (GBP), Euro (EUR) and Australian Dollar (AUD) Exchange Rates Forecast

On Wednesday the New Zealand Dollar rallied versus nearly all of its major peers thanks to positive domestic data.

Fourth-quarter Unemployment Rate was predicted to rise from 6.0% to 6.1%, but the actual result saw a massive drop to just 5.3%.

In addition, fourth-quarter Employment Change eclipsed expectations of 1.1% annual growth with the actual result reaching 1.3%.

Also supporting demand for the Oceanic asset today was positive data out of China. January’s Caixin Services PMI rose from 50.2 to 52.4. This allowed January’s Caixin Composite PMI to rise to 50.1 from 49.4; breaking through the 50 mark that separates growth from contraction.

Analysts at Westpac forecast 50 basis points worth of rate cuts from the RBNZ in 2016, stating:

‘Our analysis suggests that, relative to the Reserve Bank’s December forecasts, the extra strength of the New Zealand economy is worth about a 25 basis point OCR hike. But the weaker housing market, lower inflation outlook, and higher exchange rate are together worth about 75 basis points of OCR reductions. In other words, we think that the Reserve Bank’s forecasters will now be saying that the OCR needs to fall 50 basis points to 2.0% in order to meet the inflation target (compared to their previous assessment that 2.5% was sufficient).’

Westpac analysts predict easing to begin in March, stating:

‘The RBNZ’s forthright adoption of an easing bias, combined with our assessment that the case for cuts is now beyond doubt, has prompted us to alter slightly our thinking on timing. We have always considered either March or June this year the most likely start dates for renewed OCR reductions. We now regard March as the slightly more likely of the two dates (previously June).’

British Pound (GBP) Exchange Rates Climb Today after Services Output Bettered Expectations

On Wednesday the Pound advanced versus most of its major peers after domestic data printed positively.

January’s UK Services PMI was expected to drop from 55.5 to 55.4, but the actual result rose to 55.6. This allowed January’s Composite PMI to also better expectations of a rise from 55.3 to 55.0, with the actual result reaching 56.1.

In response to the PMI data, Chris Williamson, Chief Economist at Markit stated:

‘The economy defied expectations and picked up speed in January, but cracks continue to appear in the country’s resilience to the various headwinds. The three PMI surveys for January collectively point to a slight upturn in the rate of economic growth, consistent with GDP rising at a quarterly rate of 0.6% in the first quarter, up from 0.5% in the fourth quarter, if current levels are sustained. However, order book backlogs are already falling at the fastest rate for almost three years and companies have scaled back their hiring in response to growing uncertainty about the economic outlook at home and abroad.’

Euro Exchange Rate Cools after German, French and Italian Services Output Missed Estimates

The single currency ticked lower on Wednesday after domestic data failed to impress.

Of particular disappointment was January’s Italian, French and German Services PMIs; all of which failing to meet with expected sectoral growth.

Commenting on the Markit Germany Services PMI, Oliver Kolodseike, economist at Markit and author of the report said:

‘German service providers remained in expansion mode at the start of 2016. Although output rose to the smallest extent in three months, the underlying rate of growth was robust overall, helped by a further sharp rise in new business. Moreover, the level of positive sentiment among businesses reached a near five-year high with almost one-third of the survey panel expecting output growth over the coming year. Panellists commented that expansion plans, higher investments and the low oil price are likely to lead to increased activity.’

NZ Dollar to Australian Dollar Exchange Rates Edge Higher despite Rocky Chinese Stocks.

Although Asian share prices extended the monthly rout, with the Shanghai Composite Index declining close to 0.4% at the close of the Asian session, the Australian Dollar exchange rate advanced versus many of its currency rivals.

The appreciation can be linked to China’s positive services data which saw market sentiment improve significantly.

US Dollar weakness and rising gold prices were also contributors to the ‘Aussie’ (AID) appreciation during Wednesday’s European session.

Will New Zealand’s Unemployment Data Prevent an RBNZ Rate Cut and Drive the NZD Exchange Rate Higher?

Although investors were concerned about the prospect of the Reserve Bank of New Zealand (RBNZ) cutting interest rates in the near future prior to the publication of New Zealand’s latest employment data, the fact that the nation’s unemployment rate dropped so dramatically in the fourth quarter of 2015 has since eased these fears and bolstered the New Zealand Dollar (NZD) exchange rate. The massive drop in joblessness took investors completely by surprise. NZD gains were supported by hints that the BoJ intends to loosen fiscal policy further in the near future.

The NZD/USD exchange rate swiftly rallied to a month high.

In the view of currency strategist Jason Wong; ‘The US Dollar is weaker across the board, with the New Zealand Dollar at the top of the leaderboard. The market has been heavily positioned for US Dollar strength so liquidity can evaporate quickly when everyone wants to adjust positions at the same time.’