The Pound Sterling (GBP) remains bearish against the Japanese Yen (JPY), Turkish Lira (TRY) and the Indian Rupee (INR) as the odds of a 2016 BoE rate hike disappear.

JPY-GBP Strong on Machine Tool Orders and Safe-Haven Status

Although Machine Tool Orders in Japan continued to drop, the rate of deceleration swiftly declined, slowing from -25.7% to -17.2%, suggesting that business capital spending is recovering.

The Yen is also strengthened by its status as a safe-haven asset, with traders turning to secure investments following the fresh rout in global stocks.

Here are the latest GBP exchange rates for your reference:

On Friday the Turkish Lira to British Pound exchange rate (TRY/GBP) converts at 0.025

Today finds the pound to turkish lira spot exchange rate priced at 40.479.

The live inter-bank GBP-INR spot rate is quoted as 103.738 today.

At time of writing the pound to japanese yen exchange rate is quoted at 191.263.

Please note: the FX rates above, updated 19th Apr 2024, will have a commission applied by your typical high street bank. Currency brokers specialise in these type of foreign currency transactions and can save you up to 5% on international payments compared to the banks.

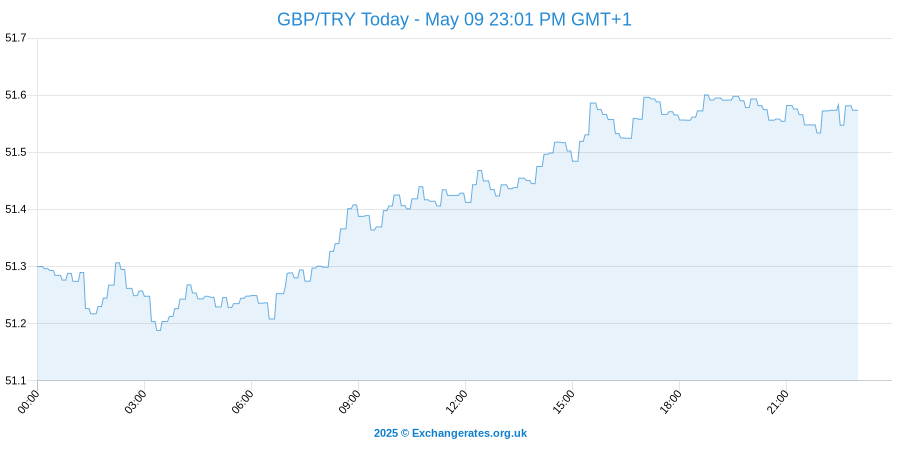

GBP-TRY Strong after Flat Turkish Retail Sales Figures

Turkish retail sales saw no growth in December, despite being forecast to rise almost 1%, after 0.7% growth the previous month.

Year-on-Year (YoY) sales printed slightly below forecast, increasing 3.7% instead of 3.8%.

Despite the slowdown from 7.7% to 7.3% in this morning’s Indian GDP figures after the previous results were revised upwards, the final figure still shows that the emerging market’s economy expanded faster than China’s.

However, there have been claims that the data might not be entirely accurate, as other data for India shows weak exports and railway freight, low cement production and a stagnation in new orders, with Ambit Capital economist Ritika Mankar calling the information ‘counterintuitive’.

In the aftermath of the Bank of England’s (BoE) more dovish policy meeting, wherein policymakers voted unanimously to keep interest rates at their current level, the Pound Sterling (GBP) has been largely struggling against rivals.

Traders were not impressed with the BoE’s decision to revise its inflation forecast lower, particularly as economics increasingly speculated that the central bank will not ultimately raise interest rates until 2017.

Friday’s US Non-Farm Payrolls report prompted a fresh round of safe-haven demand, meanwhile, as markets remain uncertain of the chances that the Fed will continue to tighten monetary policy in the near future.

Another blow came for the British Pound (GBP) on Monday as the BDO business confidence survey showed that optimism has fallen to its lowest level in three years, on the back of slowdown worries and ‘Brexit’ concerns.

It is the uncertainty of the UK’s future within the European Union which is forming a particular drag on the Pound, as James Knightley of ING notes:

’Domestically, the BoE remain relatively upbeat on the growth story, but steer clear of mentioning the Brexit referendum directly, which we think will weigh on growth. Consequently, given the lack of clarity on the near-term outlook it is no surprise to see the Bank want to keep policy steady until the situation stabilises.’

With discussions ongoing with European leaders over the draft agreement published by European Council President Donald Tusk the ‘Brexit’ debate stands likely to dominate sentiment towards the Pound over the coming weeks.

Turkish Lira (TRY) Struggles to Find Support as Industrial Production Falls Short of Forecast

Demand for the Turkish Lira (TRY) remains particularly volatile on Monday as the higher-risk currency struggles to gain traction despite this week’s closure of the Chinese stock markets, a move that has helped to generally boost market confidence.

This morning’s Turkish Industrial Production report was a little disappointing, as output failed to rise quite as far as forecast to print at 4.5% rather than a more bullish acceleration of 5.5%.

While this suggests that the Turkish economy is showing signs of improvement the Pound Sterling to Turkish Lira (GBP/TRY) exchange rate has nevertheless been regaining ground on Monday

Better-than-Expected Economic Sentiment Prompts Fresh Japanese Yen (JPY) Strength

The Japanese Yen (JPY) has been on particularly bullish form again, erasing more of the impact of the Bank of Japan’s (BoJ) surprise move to negative interest rates as the currency remains in high demand with more nervous investors.

Although the latest raft of domestic data was generally disappointing a stronger-than-expected Eco Watchers Survey Outlook reading, which climbed from 48.2 to 49.5 in January, has helped to shore up the Japanese Yen.

As confidence in the Japanese economy is apparently recovering the Pound Sterling to Japanese Yen (GBP/JPY) exchange rate has slumped sharply, with the safe-haven currency continuing to strength amidst general market turbulence.

Indian Rupee (INR) Exchange Rate Trends Higher despite Slowed GDP

While the fourth quarter Indian GDP slowed slightly from 7.4% to 7.3% as expected this hasn’t particularly weighed on the outlook of the Indian Rupee (INR) on Monday morning, as the lack of fresh volatility from China has bolstered the appeal of the emerging-market currency.

Later in the week the Rupee may strengthen further if Friday’s raft of data proves more conclusively positive, as domestic inflation is expected to weaken with the Indian trade deficit is forecast to have narrowed in January.

Should market sentiment manage to hold onto a more optimistic trend the Pound Sterling to Indian Rupee (GBP/INR) exchange rate is predicted to weaken further over the coming week.

UPDATE: Pound (GBP) Strong Despite Poor Performance from UK Industry and Manufacturing

The Pound has so far managed to escape the weakening effects of negative UK data today.

Manufacturing Production dropped -0.2% on a monthly basis and -1.7% compared to this time last year, while Industrial Production fell -1.1% in December and -0.4% on a yearly basis.