European equities finished the last trading day of the month sharply lower, as a tick up in a number of commodity prices failed to lift sentiment, and a raft of disappointing earnings dragged stocks deep into the red.

Commodities fail to lift markets

European markets

The pan-European STOXX 600 ended 2.1 percent lower provisionally. On the week, the STOXX 600 closed down 2 percent; and on the month, it jumped 1.2 percent. London's FTSE 100 fell 1.3 percent, while its European counterparts sunk even further by the close. France's CAC slumped 2.8 percent and Germany's DAX fell 2.7 percent down. All sectors closed in negative territory.

Mixed data out of Europe did little to alleviate stock markets. For the euro zone as a whole, gross domestic product (GDP) rose 0.6 percent quarter-on-quarter in the first three months of the year. Unemployment in the single currency bloc fell to 10.2 percent in March, down from 10.4 percent recorded in February. And an initial inflation estimate showed the price of goods fell 0.2 percent this month.

Asia markets closed mostly lower on Friday, as investors digested the latest central banks' decisions and the yen saw fresh strength against the dollar. In U.S. markets, stocks were in the red, as traders eyed earnings, data and currency moves.

Oil prices came under pressure at Europe's close as a Reuters survey revealed OPEC's oil output had risen in April, rising to 32.64 million barrels per day (bpd), up from March's 32.47 million bpd. Brent and U.S. crude both were in negative territory despite earlier gains, hovering at $47.63 and $45.61 respectively.

Looking at stocks, shares of Vestas rallied 4.5 percent, after the wind energy firm said its first-quarter core earnings hit 85 million euros, beating market expectations. However most oil stocks closed in the red.

Meanwhile, despite closing in the red, basic resources outperformed other sectors, as several metals saw a sharp price pick-up—such as copper, lead and gold—which helped push some stocks higher, including Glencore and Randgold Resources, which both closed above 3.5 percent.

"Quickly recapping the month, it's been the miners that have shone as commodity prices appear to be moving away from the dark days seen at the start of the year and some stability is returning to the market," Tony Cross, a market analyst at Trustnet Direct, said in a note.

Earnings disappoint; Banks tank over 3%

A number of companies reported earnings on the last trading day of the month, however most failed to boost sentiment.

British Airways-owner said its outlook for the second quarter has been affected because of the Brussels attacks and "some softness in underlying premium demand". The airline group said it has "moderated" its short-term plans to fly more routes. The news sent shares in IAG to end sharply lower, off 4.7 percent, along with German airline Lufthansa, which slipped 5.6 percent.

One bright spot in the banking sector was Danske Bank, who saw shares rally over 3.5 percent after it reported a pre-tax profit of 6.27 billion Danish krone, beating expectations, with chief executive Thomas Borgen saying the company has had a "satisfactory" start to the year.

Royal Bank of Scotland however said its losses widened in the first quarter to £968 million ($1.42 billion), up from £459 million in the same period last year. Shares slumped 6 percent.

Overall banks closed down 3.2 percent, with Italian banks weighing the sector down significantly. Unicredit saw its shares suspended during trade, finishing over 5 percent. Banco Popolare, BMPS and Intesa Sanpaolo all closed sharply lower, dragging the FTSE MIB index to close 2 percent down.

In pharmaceuticals, Sanofi saw a slight uptick in first-quarter sales and maintained its full-year guidance. The company said that it is "confident" that it will win support for its $9.3 billion bid to buy U.S. cancer drug company Medivation but investor reaction was negative sending shares tumbling over 5 percent.

Looking at the STOXX 600's biggest market movers, U.K.-listed Restaurant Group tanked 26.5 percent, after it warned on its full-year profit outlook. Meanwhile, Technicolor surged over 17.5 percent, after it confirmed its objectives for 2016 and saw a 77 percent rise in revenue for its operating businesses in the first quarter.

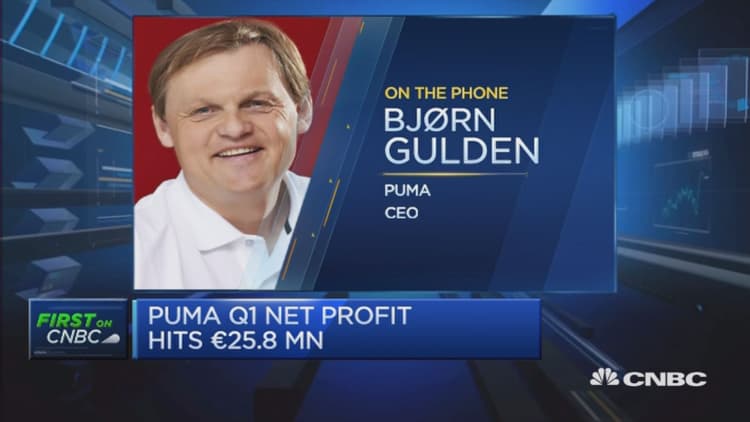

Puma down 3.5%

Spanish telecoms group Telefonica said its core profit fell 6.7 percent in the first quarter of 2016, sending shares to close down over 4 percent.

Elsewhere, German sporting goods maker Puma ended over 3.5 percent down after it reported a 3.7 percent rise in first-quarter sales as it gears up for a busy year of sports.

Reinsurer Swiss Re reported first-quarter net income of $1.2 billion, beating market expectations, but warned on challenging market conditions ahead, sending shares down 3.7 percent.