Despite verbal intervention from Japanese officials the US Dollar was unable to maintain its gains against the Japanese Yen for long this week.

Foreign exchange markets continued to largely dismiss the possibility of further intervention from the Bank of Japan (BoJ) in spite of dovish commentary from Governor Haruhiko Kuroda, pushing the Japanese Yen exchange rates (JPY) higher ahead of the weekend.

Consequently, regardless of hawkish words from members of the Federal Open Market Committee (FOMC), the US Dollar to Japanese Yen (USD/JPY) exchange rate trended lower once again.

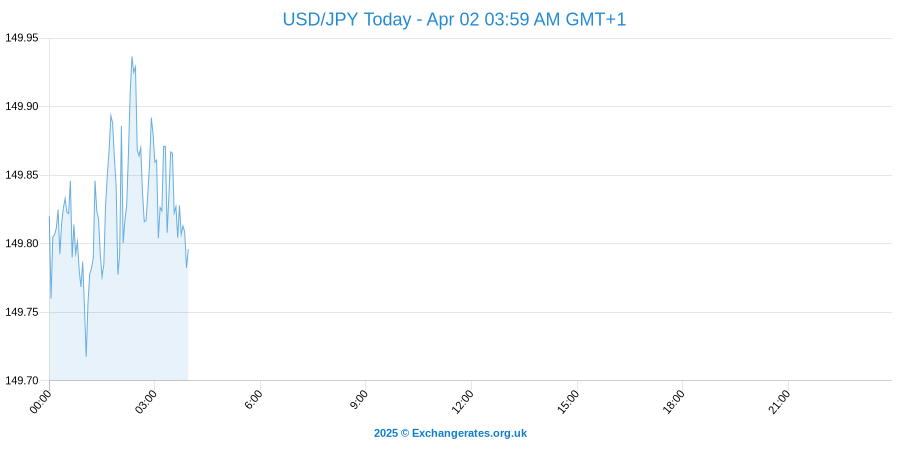

The US dollar has remained positive against the Japanese yen today, though not by as much as earlier.

The dip in USD/JPY performance may be a symptom of impending Fed speeches. As several deliveries are due to be made in a short space of time, their impact will be raised and any perceived hawkishness or dovishness is sure to be picked up on by economists.

Scotiabank suggest the pair could remain bullish in the near-term outlook:

"Both the MACD and RSI are bullish and USDJPY has broken back above its 21 day MA. We look to fresh May highs and note the absence of resistance ahead of 111.50."

An unexpectedly sharp weakening in sentiment evidenced by the latest Japanese Eco Watchers Survey allowed the dollar to yen exchange rate to rally strongly on Thursday.

Commentary from members of the Federal Open Market Committee (FOMC) could help to push the US Dollar higher later in the day, particularly if policymakers adopt a more hawkish tone towards the possibility of interest rates rising.

In spite of discouraging domestic data the US Dollar to Japanese Yen (USD/JPY) exchange rate began to trend higher in the early week, shrugging off the impact of the disappointing Non-Farm Payrolls report.

Sending large amounts of money abroad? Did you know you could save compared to using the high street banks? Get a free guide and start a chat with our team of foreign exchange experts.

However, as the likelihood of the Federal Open Market Committee (FOMC) opting to raise interest rates in June seems increasingly slim markets have struggled to maintain a more optimistic view of the US Dollar (USD).

With doubts rising over the health of the US economy investors have been inclined to generally favour its safe-haven rivals, such as the Euro (EUR) and Japanese Yen (JPY)On Thursday the Japanese Yen to British Pound exchange rate (JPY/GBP) converts at 0.005

FX markets see the pound vs japanese yen exchange rate converting at 192.351.

FX markets see the pound vs euro exchange rate converting at 1.167.

At time of writing the pound to pound exchange rate is quoted at 1.

NB: the forex rates mentioned above, revised as of 18th Apr 2024, are inter-bank prices that will require a margin from your bank. Foreign exchange brokers can save up to 5% on international payments in comparison to the banks.

This resurgence in Yen demand swiftly erased the impact of comments from Finance Minister Taro Aso, who had indicated a willingness to intervene to weaken the currency if necessary.

Although markets had initially reacted with caution to the dovish commentary there remains marked scepticism amongst investors as to the abilities of central banks to impact the FX market, particularly as monetary policy appears to be reaching its limits.

Yujiro Goto, research analyst for Nomura, noted:

‘As the upper house election approaches, avoiding further JPY appreciation will now likely be a higher priority for the government. Finance Minister Aso and Prime Minister Abe's comments still do not suggest imminent intervention at current levels, especially after the recovery of USD/JPY this week.’

Strong Leading Index Increased Demand for Japanese Yen

A notably stronger-than-expected Japanese Leading Index also helped to improve the appeal of the Yen on Wednesday, as the measure edged higher from 96.8 to 98.4.

This suggested that the domestic economy was in a less bearish state than investors had thought, prompting the USD/JPY exchange rate to return to a downtrend in the wake of a fresh surge in Yen demand.

With a raft of Japanese data due for release ahead of the weekend, however, the Yen may prove unable to sustain its current rally, particularly as BoJ Governor Haruhiko Kuroda will be making comments on Friday morning.

Improved US Retail Sales May Boost USD/JPY Exchange Rate

While upcoming US data is unlikely to substantially alter the outlook of the FOMC after last week’s poor employment figures the ‘Greenback’ could still benefit from stronger showings in the Advance Retail Sales and University of Michigan Confidence Index reports.

A solid recovery in retail sales could signal a greater turnaround in domestic consumer sentiment and pave the way for a more general improvement in the mood towards the world’s largest economy.

Further disappointment could drive the USD/JPY exchange rate sharply lower, although profit taking and consolidation trading may prevent the US Dollar from seeing another significant slump.