Core Laboratories (CLB) Q4 Earnings: Is a Beat in Store?

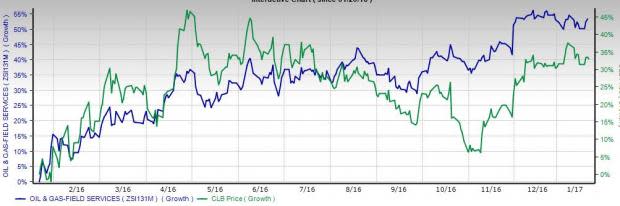

Oilfield services company Core Laboratories N.V. CLB is set to release fourth-quarter 2016 results after the closing bell on Jan 25.

In the preceding three-month period, this Amsterdam, Netherlands-based firm’s earnings were in line with the Zacks Consensus Estimate. In fact, Core Laboratories’ earnings met estimates in each of the last four quarters.

Let’s see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that Core Laboratories is likely to beat on earnings because it has the right combination of two key ingredients.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, stands at +2.50%. This is very meaningful and a leading indicator of a likely positive earnings surprise for shares.You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Core Laboratories carries a Zacks Rank #3 (Hold), which combined with +2.50% ESP makes us confident about a positive earnings beat.

Note that stocks with Zacks Ranks #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings.

Conversely, the Sell-rated stocks (#4 and 5) should never be considered going into an earnings announcement, especially when the company is seeing negative estimate revisions.

What is Driving the Better-Than-Expected Earnings?

Core Laboratories is an oilfield services company that provides reservoir management and production enhancement services to the global oil and gas industry. The company, like its peers, has been affected by the sharp fall in commodity prices.

The company’s deep portfolio of proprietary products and services positions it to operate successfully in the current environment of low commodity prices and growing maturity in the global hydrocarbon reserve base.

Additionally, Core Laboratories have been able to operate profitably even in this low commodity price environment. In fact, the existing 'lower-for-longer' oil price scenario has made the company's services even more important for energy producers that look to utilize every dollar they spend.

The company’s strong presence in the emerging shale plays and its global footprint make way for steady growth rates going forward. Also, Core Laboratories' low capital expenditure needs and service-oriented nature differentiates it from its peers.

Stocks to Consider

Here are some stocks from the Oils/Energy sector that you may want to consider, as our model shows that it has the right combination for an earnings beat this quarter.

W&T Offshore, Inc. WTI is expected to release fourth-quarter earnings results on Mar 14. The company has an Earnings ESP of +73.91% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sprague Resources LP SRLP has an Earnings ESP of +3.64% and a Zacks Rank #2. The partnership is anticipated to release fourth-quarter earnings on Mar 9.

Pioneer Natural Resources Company PXD has an Earnings ESP of +10.00% and a Zacks Rank #2. The company is likely to release fourth-quarter earnings on Feb 7.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 "Strong Buy" stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 "Strong Sells" and other private research. See these stocks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Core Laboratories NV (CLB): Free Stock Analysis Report

Pioneer Natural Resources Co. (PXD): Free Stock Analysis Report

W&T Offshore Inc. (WTI): Free Stock Analysis Report

Sprague Resources LP (SRLP): Free Stock Analysis Report

To read this article on Zacks.com click here.