Last June, we presented a chart here at See It Market showing the decline we anticipated in the Japanese Yen, by way of a related ETF (NYSEARCA:FXY). We were expecting the Yen (CURRENCY:JPY) to test near an area of prior support as the middle wave of a sideways/upward correction.

Now there are signs that the decline may be finished, and traders might begin looking for ways to take advantage of a modest bounce that could last several months.

Yen – Time To Rally?

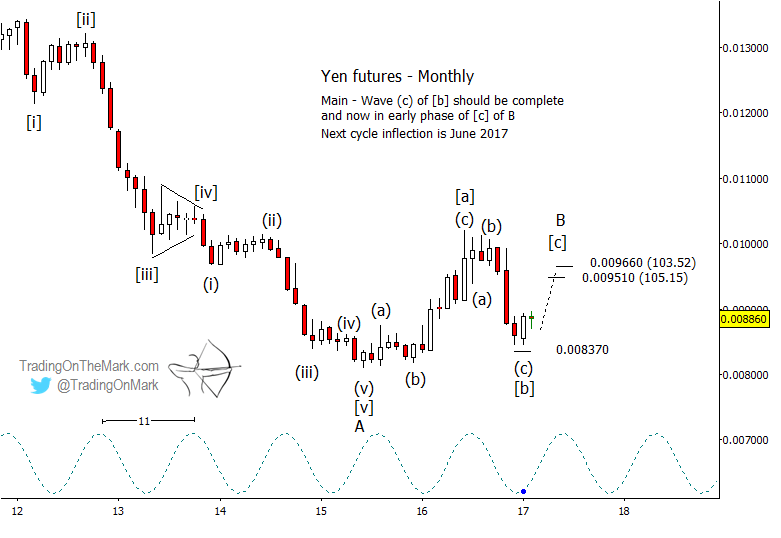

Even though we are expecting a rally, the move still would be part of a larger corrective pattern. On the chart below, we have indicated some conservative targets for expected wave [c] of the [a]-[b]-[c] sequence that began in 2015. Fibonacci-related resistance lies near 0.009510 and 0.009660 (corresponding to 105.15 and 103.52 for those watching the inverse currency pair).

If you’re an active trader, this type of charting can be your guide to finding good entries and exits. New subscribers get a full month of access to all the services we offer, including our Daily Analysis and our Intraday Analysis for just the cost of the Daily Analysis alone.

The main determinates of how high wave [c] travels probably will be the timing of the 11-month cycle and the extent to which the U.S. Dollar remains in its own corrective pattern. If the Dollar Index stays near its present value between now and mid-summer, that should lend a positive bias to Yen trades during the same time.

For context, see the monthly line-on-close chart for the Dollar Index, included below. There is room for a modest correction before Dollar bulls try again to push the index higher.

Returning to the Yen, the expected rally probably will consist of five sub-waves. The first of those may already have begun, so traders might watch for opportunity if the Yen retraces to make a higher low.

Thanks for reading.

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.