GBP/USD rebounded strongly last week, gaining 140 points. The pair closed the week at 1.2517. It’s a light week on the release front, with just one economic event, Retail Sales. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

Strong British numbers helped the pound move higher, as wage growth beat the estimate. As well, CPI conitnued to move higher. Over in the US, consumer indicators disappointed, as CPI and retail sales reports missed their estimates. However, employment and consumer confidence beat expectations

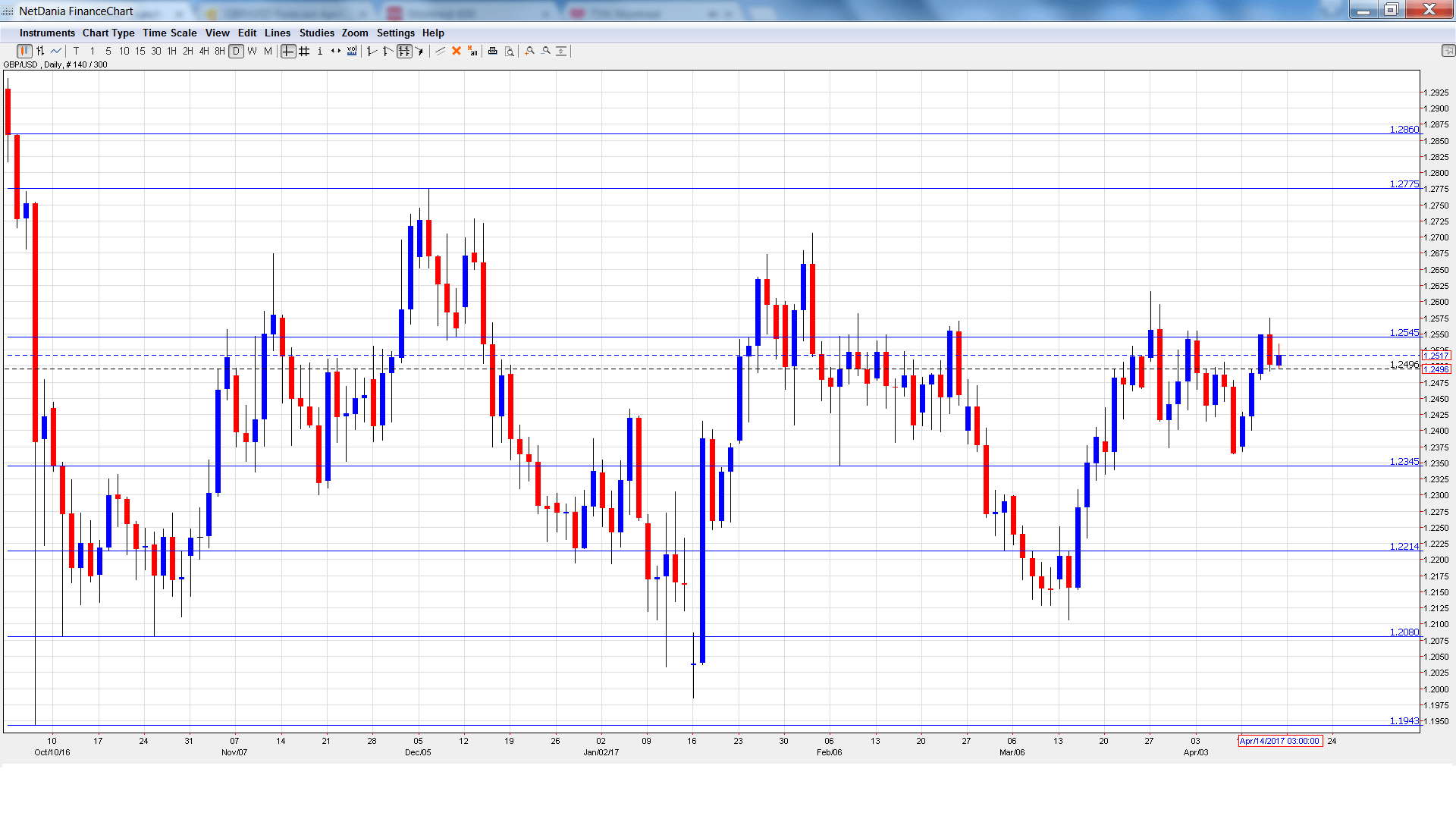

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- BoE Governor Mark Carney Speech: Thursday, 15:30: Carney will speak at the Institute of International Finance Policy Summit in Washington. A speech which is more hawkish than expected is could boost up the pound.

- BoE Governor Mark Carney Speech: Thursday, 16:30. Carney will deliver a speech at the Institute of International Finance Policy Summit in Washington. The markets will be looking for clues regarding the BoE’s monetary policy.

- Retail Sales: Friday, 8:30. This indicator measures inflation in the manufacturing sector. The index disappointed in February with a decline of -0.4%, short of the forecast of +0.2%. The markets are expecting another decline, with an estimate of -0.5%.

- External BOE MPC Member Michael Saunders Speech: Friday, 11:45. Saunders will speak at an event in London. A speech which is more hawkish than expected is bullish for the British pound.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2374 and quickly dropped to a low of 1.2367. The pair then reversed directions and climbed to a high 1.2574, as support held at 1.2548 (discussed last week). GBP/USD closed the week at 1.2517.

Technical lines from top to bottom

We start with resistance at 1.2860.

1.2775 has held in resistance since December 2016.

1.2548 is next.

1.2345 was a low point in February.

1.2213 is protecting the 1.22 level.

1.2080 is protecting the symbolic 1.20 level.

1.1943 is the final support level for now.

I am neutral on GBP/USD.

The markets remain unimpressed with Trump, who has yet to form a coherent economic agenda. Over in the UK, concerns are high that Brexit fallout could take a toll on the economy and send the pound to lower levels.

Our latest podcast is titled Brexit Bad and “Clean Coal”

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.