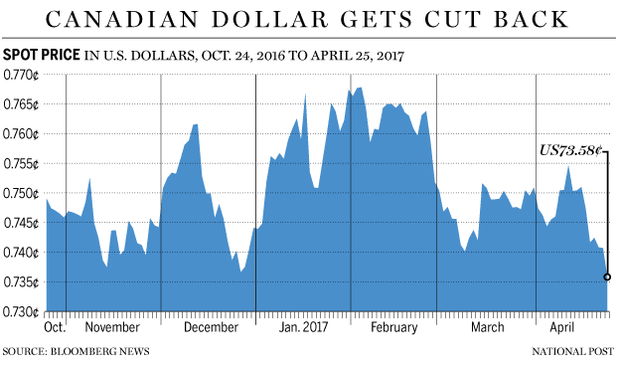

Loonie sheds half a cent to lowest in 14 months as trade tensions with United States deepen

Recent weakening in the price of oil, one of Canada's major exports, has added to pressure on the nation's currency, but some traders think the loonie selloff may be overdone

Article content

The Canadian dollar slumped to a 14-month low against its U.S. counterpart on Tuesday after the United States said it would impose preliminary anti-subsidy duties averaging 20 per cent on imports of Canadian softwood lumber.

The move sets a tense tone as the two countries and Mexico prepare to renegotiate the 23-year-old North American Free Trade Agreement.

At 9:22 a.m. ET (1322 GMT), the Canadian dollar was trading at C$1.3594 to the greenback, or 73.56 U.S. cents, weaker than Monday’s close of C$1.3516, or 73.99 U.S. cents.

The currency’s strongest level of the session was C$1.3498, while it touched its weakest since Feb. 25, 2016, at C$1.3615.

“The Canadian dollar has extended its recent weakening trend overnight, with a not-too-surprising move by the U.S. to impose duties on Canadian softwood lumber being part of the backdrop,” Avery Shenfeld, economist at the CIBC World Markets Inc. said in a note.

“More telling will be how the broader NAFTA talks go, and in the immediate future, a Trump tax reform proposal due this week that we expect will reject a border adjustment tax.”

The reaction to the news leaves potential opportunity, as the Canadian dollar weakness is “likely overdone” short-term with offers into C$1.3600, traders in Toronto told Bloomberg News, as lumber accounts for 0.2 per cent of Canadian exports.

Recent weakening in the price of oil, one of Canada’s major exports, has added to pressure on the nation’s currency amid doubts about the Organization of the Petroleum Exporting Countries’ ability to reduce global crude inventories.

U.S. crude was down 0.30 percent at $49.08 a barrel.

Canadian government bond prices were lower across the yield curve in sympathy with U.S. Treasuries. The two-year fell 3.5 Canadian cents to yield 0.757 percent, and the 10-year declined 27 Canadian cents to yield 1.52 percent.

Canadian retail sales data for February is due on Wednesday.

© Thomson Reuters 2017, with files from Financial Post Staff