We do not believe the French election watershed moment for CHF. The uptrend in CHF was doubtless aggravated by political risk, and this is apparent from the accelerated intervention the SNB has needed to undertake this year to stabilize EURCHF (at an annualized 20% of GDP intervention is double the pace of last year and double the size of the current account surplus).

However, we disagree that the private sector inflows into CHF have been primarily speculative in nature (hedging by Swiss corporates, for instance, is not speculative in so far as it represents demand which is merely brought forward in time; it is not necessarily temporary demand that will reverse in the way that says hedge fund purchases would).

Equally, we do not believe that the policy tapering from the ECB will be sufficient to reverse the balance of payments pressure for CHF appreciation as there is a strong case for the SNB to undertake tapering of its own, not least as it will lack a political pretext in one weeks’ time to continue intervening at a pace that would otherwise be evidence of manipulative intent. We will watch the SNB’s weekly sight depo data with greater interest in the wake of the French election to gauge the SNB’s appetite for continued large-scale intervention.

Overall, we are comfortable with the existing cash position in EURCHF, albeit the strikes on the USDCHF have proved frustratingly elusive as expiry looms next week.

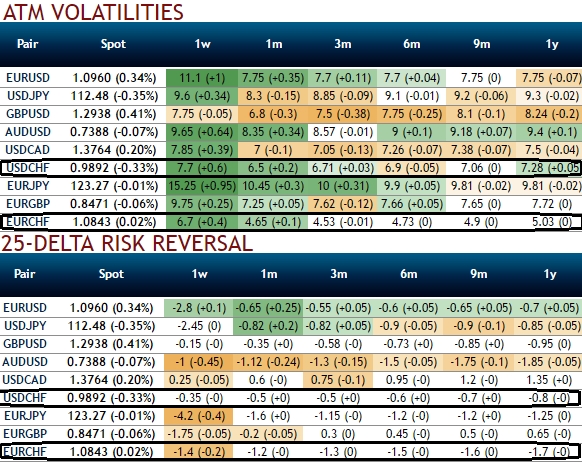

Please be noted that implied volatilities of USDCHF have been comparatively higher than EURCHF, while delta risk reversals of both pairs indicate bearish risks. Accordingly, to favor OTC indications we advocate below trade recommendations:

Hold a 2m 1.0010 - 0.95 USDCHF debit put spread.

Stay short EURCHF in cash although you have seen sharp spikes that seem momentary, we are expecting a considerable pullback from bearish rallies. Marked at -1.23%.

Impact of Iran-Israel conflict on Stocks, Gold and Bitcoin

Impact of Iran-Israel conflict on Stocks, Gold and Bitcoin  FxWirePro- Gold Daily Outlook

FxWirePro- Gold Daily Outlook  Half our colleagues suffer pain and discomfort from periods. But they’re still a taboo subject at work

Half our colleagues suffer pain and discomfort from periods. But they’re still a taboo subject at work  Our laser technique can tell apart elephant and mammoth ivory – here’s how it may disrupt the ivory trade

Our laser technique can tell apart elephant and mammoth ivory – here’s how it may disrupt the ivory trade  FxWirePro- Gold Dailty Outlook

FxWirePro- Gold Dailty Outlook  FxWirePro- Gold Daily Outlook

FxWirePro- Gold Daily Outlook  How breakdancing became the latest Olympic sport

How breakdancing became the latest Olympic sport  Flare - EVM based Layer 1 Blockchain

Flare - EVM based Layer 1 Blockchain  From the coast to the deep sea, changing oxygen levels affect marine life in different ways

From the coast to the deep sea, changing oxygen levels affect marine life in different ways  FxWirePro- Gold Daily Outlook

FxWirePro- Gold Daily Outlook