The Australian dollar peak looks well and truly in:

The driver of weakness is the plunging yield spread to the USD which hit new wides across the curve last night as lousy Australian wages and confident Fed collided:

The five year spread is approaching record lows. The ten year spread is now at -9bps, its lowest since 1984:

This is a building gale directly into the Australian dollar’s face. Add that China has not even slowed yet, nor bulk commodities corrected, and the downside potential for the AUD/USD later this year is obvious.

————————————————

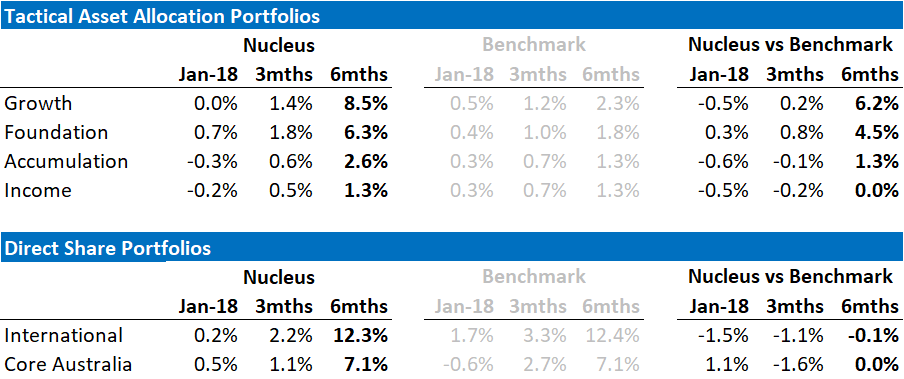

David Llewellyn-Smith is chief strategist at the MB Fund which is currently overweight international equities that will benefit from a weaker AUD so he definitely talking his book. Fund performance is below:

If these themes interest you then contact us below.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance.