Hong Kong dollar falls to 33-year low as Fed rate decision approaches

Hong Kong’s dollar fell to its weakest level against the US dollar in 33 years on Monday as traders look ahead to this week’s Federal Reserve interest rate meeting.

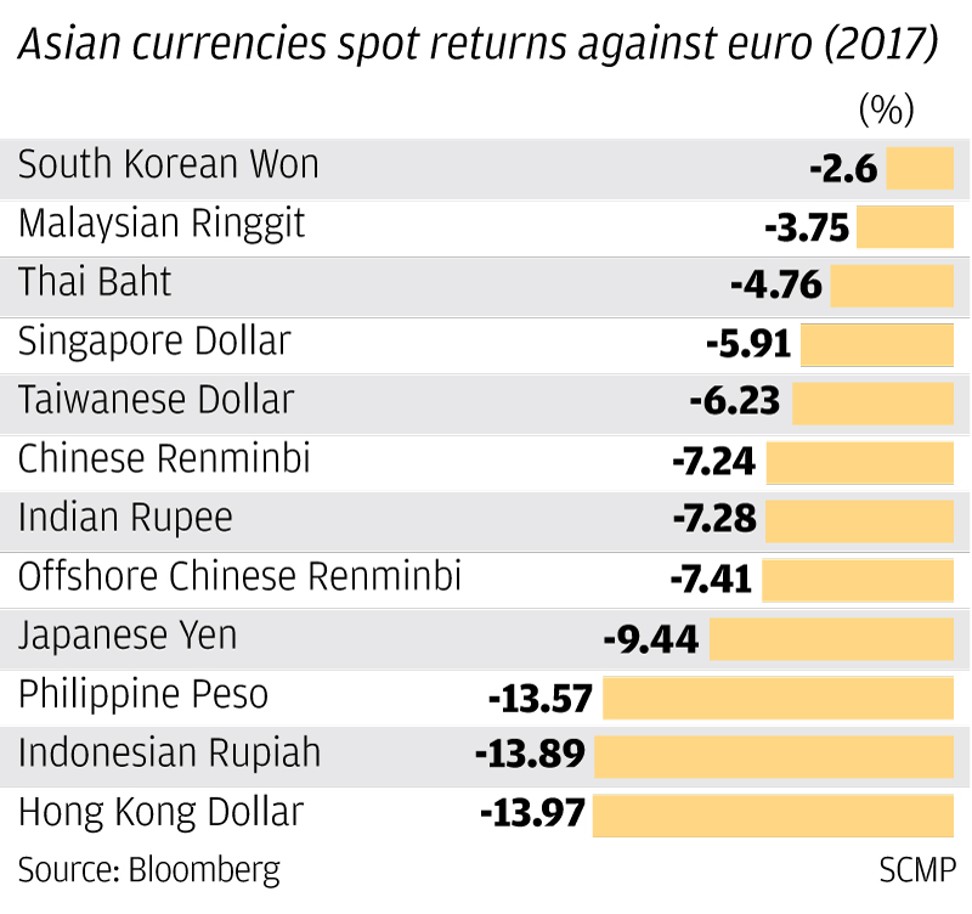

The city’s currency eased to 7.8447 per dollar, its lowest since September 1984. It is down 0.23 per cent so far this month, the worst performer among Asia’s 11 most traded currencies, according to Bloomberg data.

The Hong Kong dollar, pegged at 7.8 against the greenback since 1983, is supposed to move within a trading band of between 7.7500 and 7.8500. When it breaches the upper or lower limits of the band, the HKMA is mandated to either buy or sell the currency to bring it back within the band.

The market expects the Fed to raise interest rates by 25 basis points on Wednesday when the new chairman Jerome Powell holds his first two-day meeting, which is triggering a stronger US dollar and a weaker Hong Kong currency.

“The US dollar has begun the new week on firm footing, rising against most of the major currencies,” said Marc Chandler, global head of currency strategy at Brown Brothers Harriman. “The failure to raise interest rates would be significantly more disruptive than a hike at this juncture.”

Traders are conducting an arbitrage trade by selling low-yielding Hong Kong dollars to buy a high-yielding US currency as they take advantage of the price difference between their borrowing costs.

The local borrowing cost, known as the Hong Kong interbank offered rate (Hibor), has been rising

across all maturities in recent weeks, reflecting an overall tightening of funds in the city.

For example, 1-month Hibor has risen about 5 basis points in the past two weeks to 0.78 per cent, its highest level since February 7.

But the US borrowing cost, known as the Libor, rose at a faster pace, up 13 basis points. This has widened the Hibor-Libor spread, allowing traders to continue making the arbitrage trade, which in turn exerts depreciation pressure on the local currency.

OCBC Wing Hang Bank said in a research note that Hong Kong’s ratio of total household debt to economic output reached a record high of 69 per cent at the end of 2017. That has made the economy more vulnerable to rising interest rates, which weakens the repayment ability of property developers and residents.