Hong Kong’s monetary authority raises lending rate to 2 per cent to defend peg, raise mortgages

After an increase in US interest rates, the Hong Kong Monetary Authority moves to maintain the HK dollar’s tie to US currency.

The Hong Kong Monetary Authority on Thursday morning raised the city’s base lending rate, in lockstep with a similar increase by the US Federal Reserve to defend the local currency’s peg and add upwards pressure to mortgage payments linked to interbank rates.

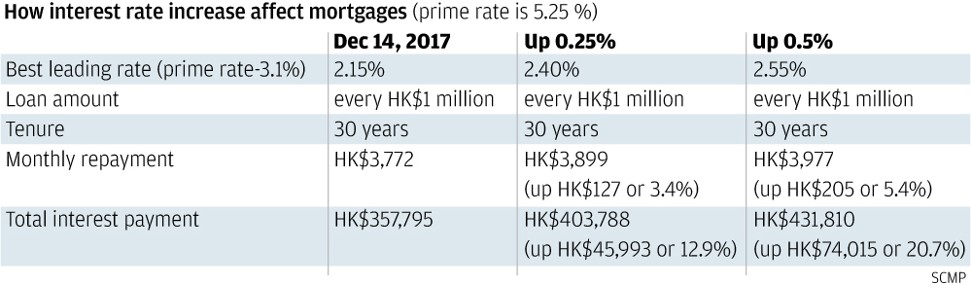

The base lending rate rose by 25 basis points to 2 per cent, matching an increase of the same quantum by the US central bank. Mortgage payments linked to the Hong Kong Interbank Offered Rates, or Hibor, would increase. One-month Hibor rose to 0.81 per cent on Thursday while the three-month Hibor rose to 1.11 per cent.

“The latest rate increase is going to add burden to many Hong Kong mortgage borrowers who link their monthly payments to the Hibor, which moves in line with the HKMA’s official rates,” said Gordon Tsui Luen-on, managing director of Hantec Pacific. “The six rounds of US rate increases since December 2015 have boosted the Hibor-linked mortgage loans by 50 basis points to over 2 per cent, compared with six months ago.”

The much-anticipated move by the HKMA did little to slow the Hong Kong dollar’s deterioration to its weakest level in 35 years. The local currency changed hands at 7.8457 per US dollar yesterday, near the lower limit of a decade-old trading band of between 7.75 and 7.85 per US dollar.

“The Hong Kong dollar is now on the edge of the weak end of the peg,” said the HKMA’s chief executive Norman Chan Tak-lam, at a press briefing during which he affirmed the authority’s commitment to defend the Hong Kong dollar’s peg to the greenback. “Once the threshold is touched, HKMA will defend the peg by buying the Hong Kong dollar and selling the US dollar.”

Chan said such action would cut down liquidity of the local banking system and force banks to increase their lending rates.

Lessons from 1997 show it’s scary being a Hong Kong dollar bear

“The interest rate increase in the US will add further pressure on the Hong Kong dollar, because currency traders can earn a bigger profit by buying the greenback and dumping the local dollar,” a practice called carry trade, said Jasper Lo Cho-yan, senior vice-president at iBest, part of Haitong International Securities in Hong Kong.

Hong Kong’s stock market fell following the HKMA’s interest rate move, partly weighed down by the prospect of punitive tariffs by US President Donald Trump on Chinese products. The Hang Seng Index fell for a second day, dropping 1.1 per cent to 3,959.50 while the Hang Seng China Enterprises Index weakened for a fifth day, declining 0.8 per cent to 1,583.69.

The reactions of Asian equity and foreign exchange markets to the US Fed move should be fairly muted given the lack of surprises in the announcement, said JPMorgan Asset management’s Asia-Pacific chief market strategist Tai Hui.

“A number of money markets in the region – Hong Kong, Singapore and Australia – have seen their local interest rates surge in recent weeks due to higher rates in the US,” so the reactions aren’t surprising, he said.

China’s central bank also increased the cost of short-term loans to commercial lenders, tightening policy in step with the US Fed. The People’s Bank of China raised the cost of seven-day reverse-repos to 2.55 per cent, and skipped the use of 14-, 28- and 63-day agreements.