As ViacomCBS releases its latest earnings report, Parrot Analytics has found that the high US audience demand for ViacomCBS content is not being correctly leveraged to set up Paramount+ for success, and that ViacomCBS is propping up the demand of Paramount+’s direct competitors including Netflix, Hulu, and Amazon Prime Video.

In Q2 2021, ViacomCBS had the second highest corporate demand share of any media conglomerate in the US, behind only Disney.

Meanwhile, Paramount+ was merely the sixth most in-demand streaming platform in US audience demand for all on-platform content, and the seventh most in-demand streaming platform for digital original content.

What’s going on here? ViacomCBS has decided to go for guaranteed revenue now by licensing out its most in-demand series - such as Criminal Minds, NCIS, Shameless, and Spongebob Squarepants - to other streaming platforms. In fact, ViacomCBS content makes up 7.4% of the licensed catalog demand for Hulu, 24.8% for Amazon Prime Video, and 25.6% for Netflix.

Demand for exclusive content - both original and licensed - is the key driver of subscription growth and retention for streaming services, so if ViacomCBS wants to truly compete in the crowded SVOD space, they have to pull back their licensed content and make it exclusive to Paramount+.

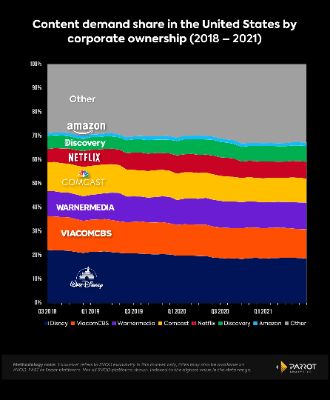

Corporate Demand Share

- In terms of corporate demand share - a consolidation of original demand where platforms are combined based on their corporate parent to show where audience attention is ultimately going - ViacomCBS (12.3%) was second place in the US in Q2 2021, behind Disney (18.9%) but ahead of WarnerMedia (11%) and Comcast (10.3%).

- This suggests that the company can find smarter ways to consolidate the availability of its highly in demand content on its own streaming platform.

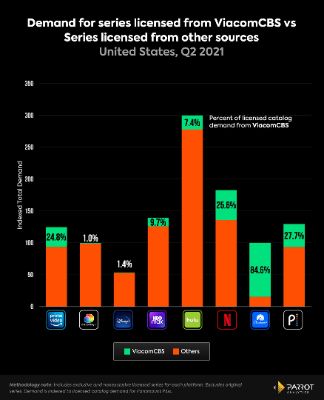

ViacomCBS’s Licensing Strategy Generates Revenue, but Bulks up Competitors

- We have separated out the demand for licensed titles (no originals) on major US SVOD platforms and highlighted the demand for ViacomCBS series [as per methodology of corporate demand share chart above].

- This shows how ViacomCBS series are driving major portions of demand for other US SVODs.

- Around a quarter of all demand for licensed series on Netflix is for a ViacomCBS series such as Avatar: The Last Airbender.

- This is around the same proportion for Amazon Prime Video and Peacock.

- Currently the audience attention for ViacomCBS series licensed to other platforms is benefiting those platforms. The chart shows that if all these series were reclaimed by ViacomCBS and made exclusively available on Paramount Plus, it would have a formidable library.

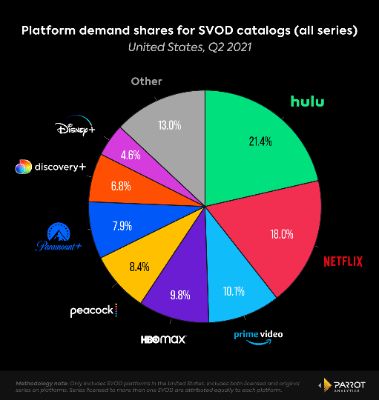

On Platform Demand Share

- As it stands, in terms of on platform demand share - which includes demand for original, exclusive licensed, and non-exclusive licensed content - Paramount+ is in sixth place of the major streamers with 7.9% share in the US in Q2 2021.

- It trails its most similar competitor Peacock (8.4%), and leads both Discovery+ (6.8%) and Disney+ (4.6%).

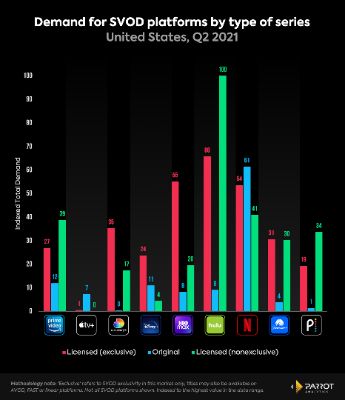

Demand for Types of Series

- Nearly half of the demand for content on Paramount+ is non-exclusive to the platform, and the platform is significantly lagging in total demand for its original series.

- This is important because demand for exclusive licensed and original content is what drives consumers to subscribe to platforms.

- By lacking exclusive rights to nearly half the demand for content on its platform, Paramount+ is losing out on potential subscriber growth and retention, despite the high demand for ViacomCBS content overall.

John Mazenier: Gaffer Tape And Glue Delivering New Zealand’s Mission Critical Services

John Mazenier: Gaffer Tape And Glue Delivering New Zealand’s Mission Critical Services Earthquake Commission: Ivan Skinner Award Winner Inspired By Real-life Earthquake Experience

Earthquake Commission: Ivan Skinner Award Winner Inspired By Real-life Earthquake Experience Reserve Bank: Consultation Opens On A Digital Currency For New Zealand

Reserve Bank: Consultation Opens On A Digital Currency For New Zealand NIWA: Ship Anchors May Cause Extensive And Long-lasting Damage To The Seafloor, According To New Research

NIWA: Ship Anchors May Cause Extensive And Long-lasting Damage To The Seafloor, According To New Research New Zealand Customs Service: A Step Forward For Simpler Trade Between New Zealand And Singapore

New Zealand Customs Service: A Step Forward For Simpler Trade Between New Zealand And Singapore Horizon Research: 68% Say Make Banks Offer Fraud Protection

Horizon Research: 68% Say Make Banks Offer Fraud Protection